How Blockchain Is Revolutionizing the Financial Sector

Understanding what blockchain is means understanding the future financial.

If you’ve heard of blockchain, you know it’s a topic that’s changing the world, especially the financial sector.

But what exactly is this technology that promises more security, transparency, and agility in transactions?

Blockchain is an innovative way to record and share information that is rewriting many of the old rules of money and banking.

This innovation enables a new way of analyzing finances, where everything is recorded securely and accessibly, without relying so heavily on traditional institutions.

But blockchain’s impact goes far beyond that. It’s creating new paths for financial services to become more faster, cheaper, and inclusive, even for those who’ve never had access to a bank.

In this article, we’ll show why blockchain is so important for the future of finance and how it’s helping to build a more efficient and fair system for everyone.

1. What is the Concept of Blockchain and How does it Function?

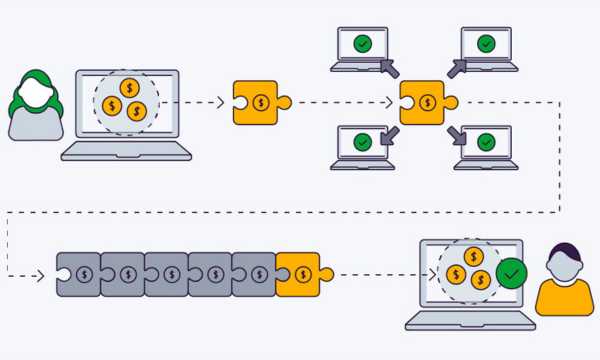

Blockchain technology works like a public digital record, but much safer. In it, information is organized into small groups called digital blocks.

Illustrative image of what Blockchain is (Google Source)

Each block stores data and has a special digital seal that helps make sure no one has changed the information.

This makes it very hard for anyone to cheat the system or change what’s recorded, since any change in a block is quickly noticed by everyone. That’s why this technology is known for being secure and trustworthy.

Also, there isn’t a single person or company in control. The system is managed by many people from different parts of the world, all helping to keep things running smoothly.

This way, everyone can check what’s happening in this record, but personal information stays protected. So, blockchain manages to be transparent without giving up privacy.

2. Applications of This Technology in the Financial Market

This technology is already being used across various fronts in the financial sector, delivering practical improvements that directly affect the daily lives of people and companies.

Some of its benefits:

- Cost reduction by eliminating intermediaries like banks and notaries

- It helps speed up processes that previously took days or even weeks.

- The use of decentralized platforms simplifies access to financial services.

Moreover, traditional financial institutions are exploring ways to integrate this technology into their operations.

Central banks are already studying the creation of digital currencies (CBDCs) that would run on blockchain-based networks.

Companies in the insurance sector, brokerage firms, and even payment systems are testing blockchain-based solutions to reduce bureaucracy and make their services more efficient.

3. Smart Contracts: Automation and Transparency in Finance

One of the most powerful features of blockchain is the so-called smart contracts. These are lines of code that automatically execute actions when specific conditions are met.

In other words, they are self-executing digital agreements. Imagine, for example, an automatic insurance payment triggered as soon as a specific condition is verified (like a flight delay). Everything happens without the need for a clerk or analyst.

This type of automation eliminates intermediaries, reduces operational costs, and boosts transaction speed. Even better: since everything is recorded on the blockchain, it’s impossible to delete or hide contract terms or actions.

They are extremely useful in areas such as investments, loans, insurance, and even real estate. The result is greater trust among parties and a smoother experience for the end user.

4. DeFi: How Blockchain Creates New Financial Services

The world of decentralized finance, or DeFi, is perhaps the most practical example of how blockchain can transform the way we deal with money.

These are financial services built on public blockchain networks, fully open and without intermediaries.

Instead of relying on a bank to take out a loan or invest your money, in DeFi you interact directly with platforms that operate through smart contracts.

Here’s what you can do with DeFi:

- Take out loans automatically using cryptocurrencies as collateral

- Invest in protocols offering returns based on network activity

- Swap digital currencies directly with others, without traditional brokers

- Manage your own wallet independently and with full control

All of this happens in real time, with lower costs and more autonomy for the user. DeFi doesn’t depend on business hours, requires no credit analysis, and works anywhere there’s internet access.

5. Advantages and Challenges of This Technology in Finance

Blockchain offers a range of concrete benefits for the financial sector.

Some are already being experienced by those who use solutions based on this technology.

- Enhanced security, with encrypted data and immutable records

- Transparency in all transactions, with a history accessible to all users

- Lower operational costs thanks to fewer intermediaries

- Faster transactions, even across different countries

- Financial inclusion, with access to services even without a bank account

However, like any emerging technology, blockchain also faces important obstacles.

- Scalability: some networks still have speed and volume limitations

- Regulation: many countries still don’t know how to address this technology

- Digital literacy: most people still don’t understand how to use these tools

- Energy consumption: blockchains based on proof of work consume a lot of energy

It’s worth noting that to reduce this impact, many networks are already adopting the Proof of Stake model, which consumes much less energy than the traditional Proof of Work, without compromising security or efficiency.

6. What to Expect from Blockchain in the World of Finance

The future of blockchain in the financial sector is full of opportunities.

What now seems innovative may soon become a part of everyday financial life.

- Official digital currencies are expected to become widespread with of government institutions support

- Integration between traditional banks and decentralized platforms has already begun

- Smart contracts may soon be used for everyday purchases

- Transparency and auditability will become standard in financial operations

Companies that embrace this technology early will get ahead, offering greater value to their customers. And consumers will also have more tools to make informed, conscious decisions about their money.

Conclusion

Without a doubt, blockchain is far from just a passing trend. It is a solid foundation for building a fairer, more open, and efficient system. And best of all: this transformation is only just beginning.

Enjoyed learning how this technology is reshaping the financial sector? Stick with us to discover more content about technology, innovation, and the future financial!

What Are the Share Market Trends for the Coming Years?

What Are the Share Market Trends for the Coming Years?

The share market is changing, and you can grow with it. Keep reading and learn more about this universe! Ad The share market is in constant […]

Keep reading 6 Essential Tips to Protect Your Crypto Investments

6 Essential Tips to Protect Your Crypto Investments

Exploring the digital world and making your crypto investments can be an exciting journey full of opportunities. Ad However, as with any promising venture, taking crucial […]

Keep reading Tips for Beginners to Easily Analyze Crypto Charts

Tips for Beginners to Easily Analyze Crypto Charts

Analyzing crypto charts can seem intimidating at first, but it’s simpler than you might imagine. Ad If you’re starting out in the world of cryptocurrencies, you’ve […]

Keep reading